Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-12-10 • Updated

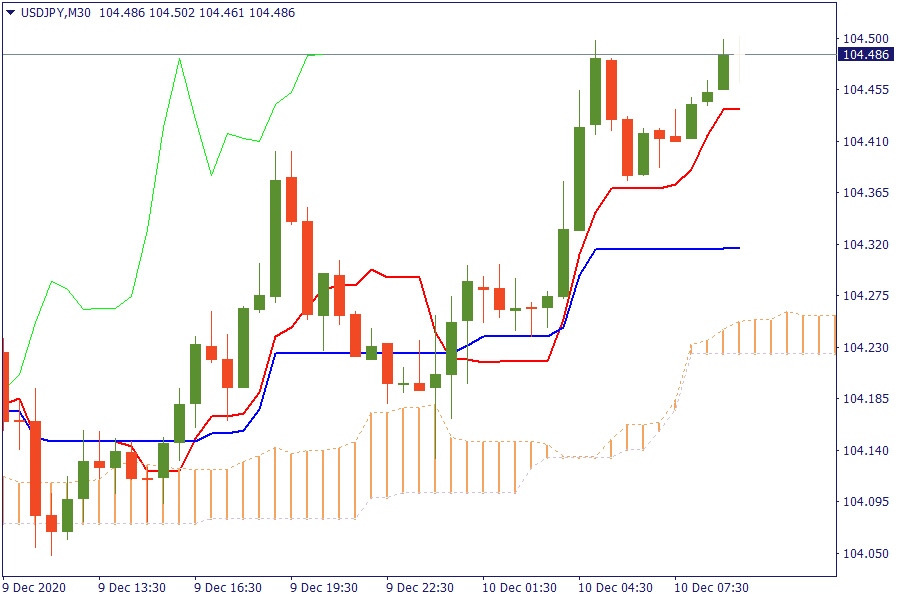

USD/JPY: The pair is trading above the cloud. Further bullish pressure will lead the currency pair to retest the previous highs.

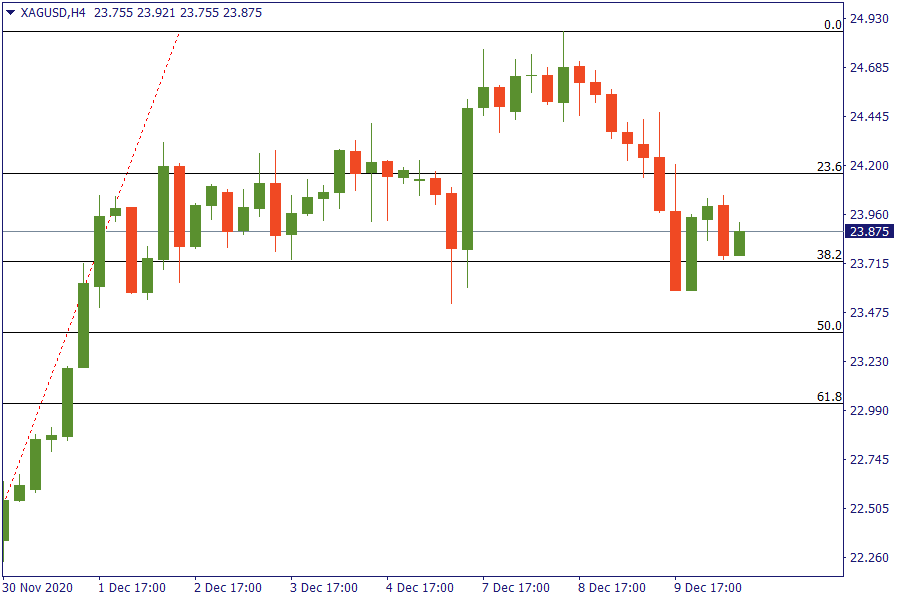

XAG/USD: Silver moves above 38.2 % retracement level. It seems that gold bulls the last day lose control.

Asian equity markets were cautious amid headwinds from the soured mood on Wall St with the downturn led by hefty losses in the Nasdaq. The Dow cut its gains to turn negative Wednesday, as a fall in technology stocks and a lack of progress over negotiations on Capitol Hill over a stimulus relief package weighed on investor sentiment. The lack of progress on stimulus has been overshadowed by positive vaccine news. But as the rollout of a vaccine nears, Stifel said deliveries this month could fall short of target. The United States set a single-day record on Wednesday of more than 3,000 deaths linked to the novel coronavirus, according to a Washington Post analysis. Texas, Colorado, Illinois and Pennsylvania led the way, with each state reporting more than 200 deaths

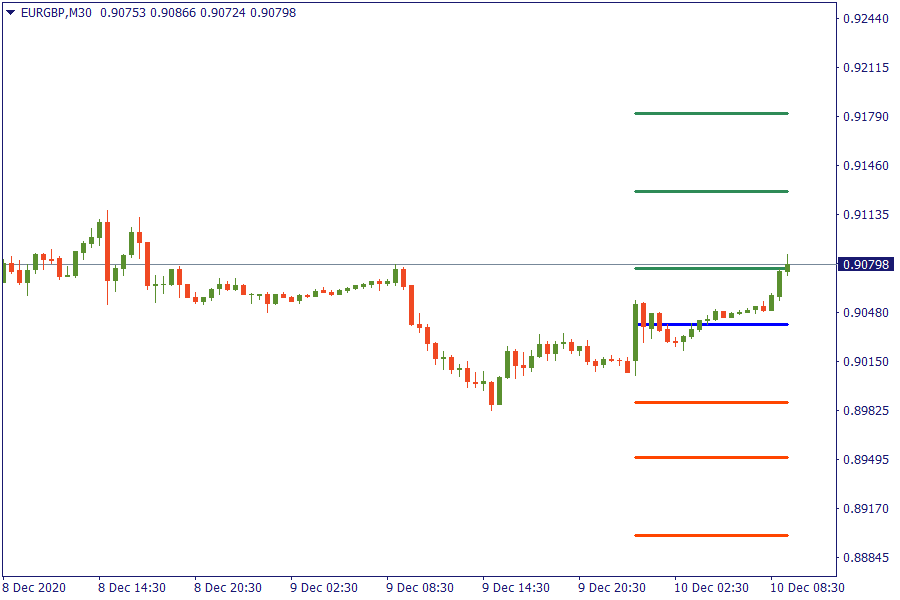

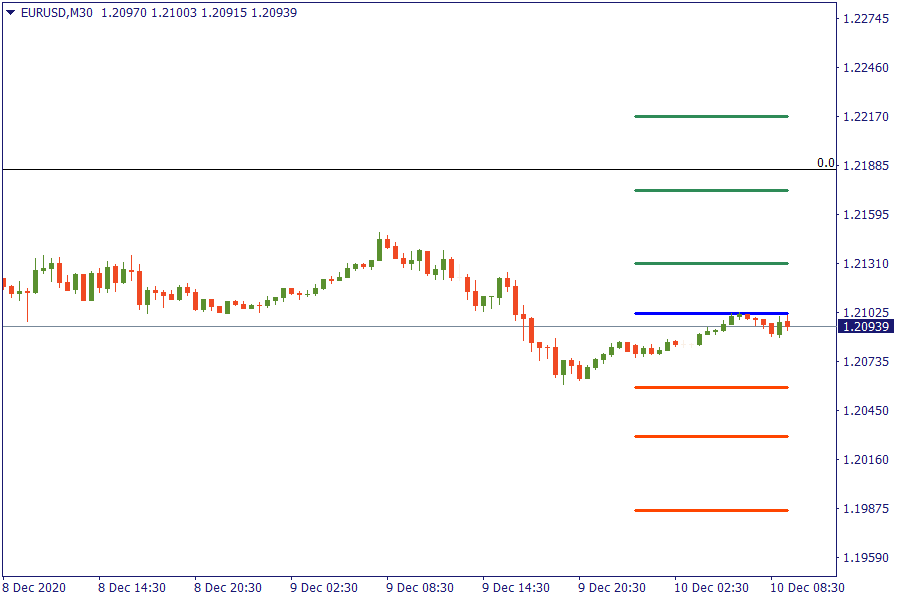

ECB knows that only monetary policy won't be the answer to boosting inflation back to target levels and fiscal action is needed as well. Euro has been one of the best performing major currencies, having appreciated 8% against the Dollar so far while rebounding 14% from the March lows.

Looking ahead, highlights rom macroeconomic calendar include UK GDP and output data, Swedish inflation, ECB rate decision & press conference, US CPI, IJC, EU Council Meeting, BoC's Beaudry, FDA EUA meeting

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!